A trusted financial partner for Filipinos

Provide loans to individuals or businesses to solve financial problems

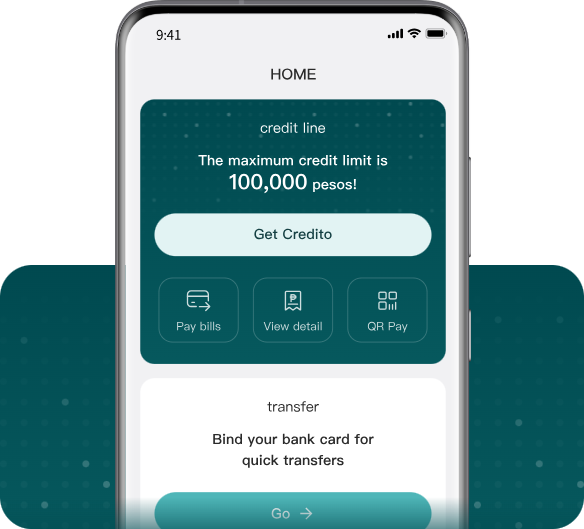

Credit loan

Introduce

Quota:₱3,000~₱500,000

Quota:₱3,000~₱500,000

annual interest rate:15%~25%

annual interest rate:15%~25%

cycle:91~120 days

cycle:91~120 days

Application method:on-line

Application method:on-line

Application conditions

Fixed job ≥1 year

Fixed job ≥1 year

Have a bank account

Have a bank account

Good credit

Good credit

Pay slips or bank statements from the last three months

Pay slips or bank statements from the last three months

Age:21 to 61

Age:21 to 61

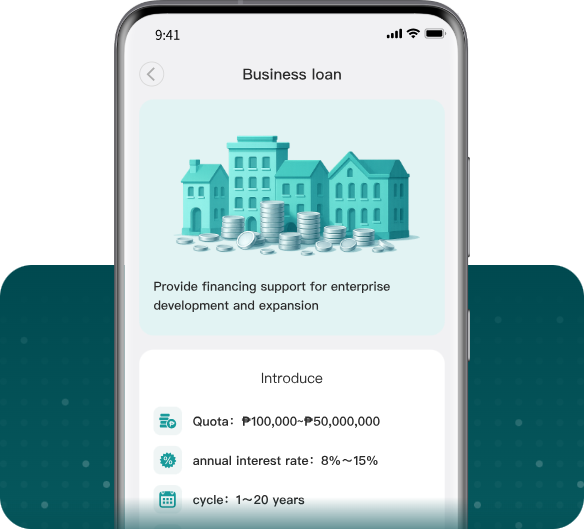

Business loan

Introduce

Quota:₱100,000~₱50,000,000

Quota:₱100,000~₱50,000,000

annual interest rate:8%~15%

annual interest rate:8%~15%

cycle:91~120 days

cycle:91~120 days

Optional collateral/uncollateral

Optional collateral/uncollateral

Application conditions

Register a business(DTI/SEC)

Register a business(DTI/SEC)

Operating for more than 2 years

Operating for more than 2 years

Sound financial statements

Sound financial statements

The company has no legal disputes

The company has no legal disputes

The company has more than 10 employees

The company has more than 10 employees

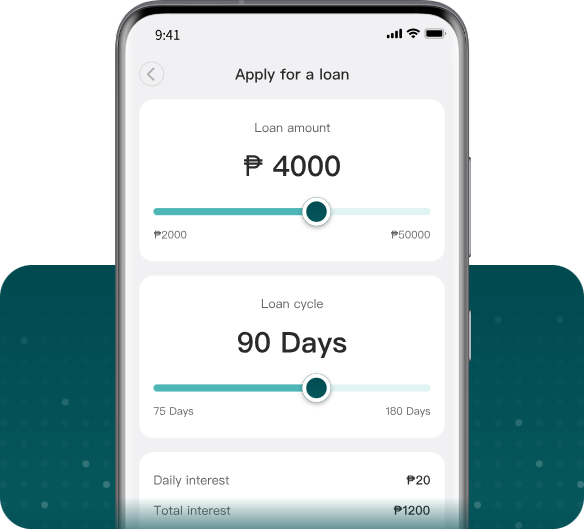

Personal loan

Introduce

Quota:₱3,000~₱500,000

Quota:₱3,000~₱500,000

annual interest rate:12%~25%

annual interest rate:12%~25%

cycle:91~180 days

cycle:91~180 days

Early repayment possible

Early repayment possible

Application conditions

Philippine citizen

Philippine citizen

Have stable income

Have stable income

Have a bank account

Have a bank account

Pay slips or bank statements from the last three months

Pay slips or bank statements from the last three months

Age:21 to 61

Age:21 to 61

The Finbubu app is operated by Finbubu Limited and functions as a Platform-as-a-Service (PaaS) provider. All financial products and services available through the app are issued exclusively by licensed subsidiaries of Finbubu Limited in the Philippines.

- First Quantum Financing Corporation, a financing company registered with the Securities and Exchange Commission (SEC) (SEC Reg. No. CS201825674, C.A. No. 1195), provides credit services through its Online Lending Platform, LoanOnline.

- Rural Bank of Kibawe (Bukidnon), Inc., licensed by the Bangko Sentral ng Pilipinas (BSP), provides deposit and basic electronic financial services (EPFS).

Finbubu Limited does not issue financial products and acts solely as the technology platform provider. All services offered through the app are available only to users located in the Philippines and require a Philippine mobile number for registration and access.